France

France is known for its high quality of life, stable economy, and vast opportunities for implementing long-term investment plans. If you are interested in this beautiful country or have investment interests tied to it, here you will find up-to-date information on taxes, legal aspects, and strategies for building and growing wealth.

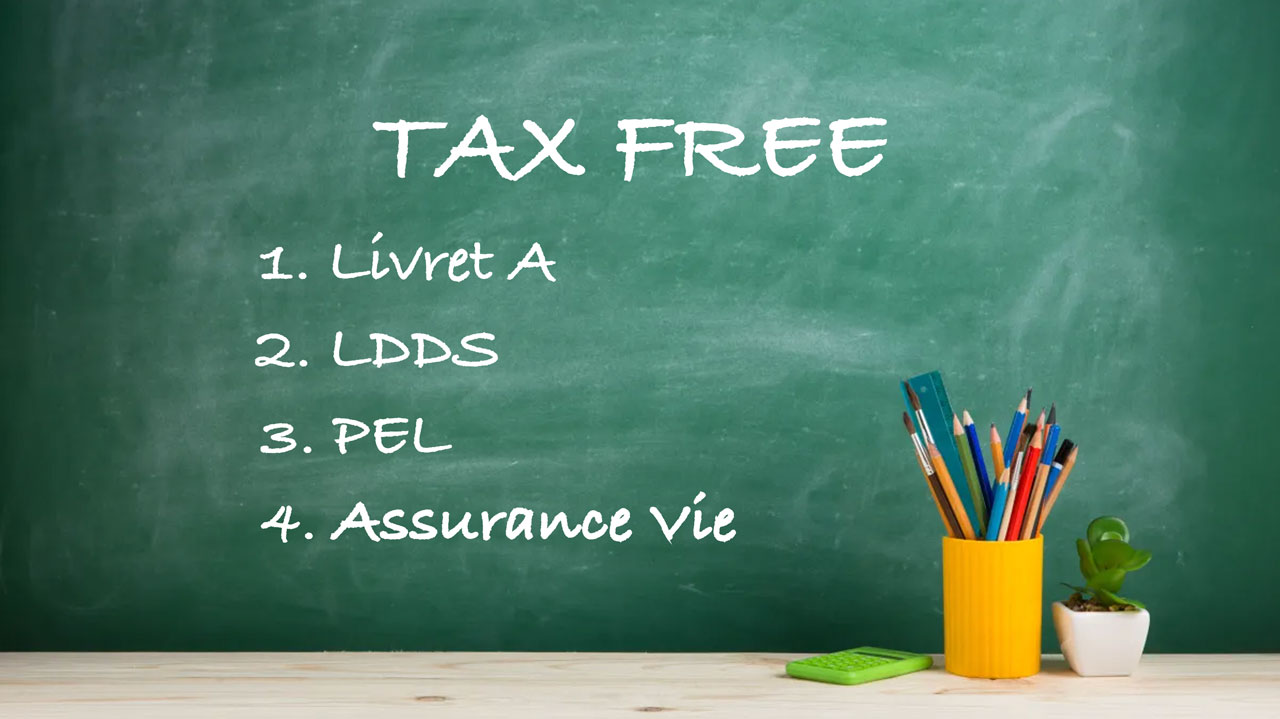

Tax-Free Investment Options in France

Claire Venard

If you're exploring tax-free investment opportunities in France, you'll be pleased to know that the country offers robust options for …

Tax residency in France

Mathieu Fiscalis

Tax residency in France is determined by national legislation, which uses the concept of "tax domicile" as equivalent to tax …

Taxes on Investments in France

Mathieu Fiscalis

By regularly setting aside part of your income for investments, you can gradually build capital and create a significant financial …

Tax Declaration in France for Entrepreneurs

Mathieu Fiscalis

In France, individual entrepreneurs (auto-entrepreneur or micro-entreprise) are required to submit a tax declaration (declaration impot) and a social contribution …

Taxes in France for Individual Entrepreneurs

Mathieu Fiscalis

If you are a young entrepreneur dreaming of launching your startup in France, it's crucial to understand taxes right away. …

Tax Systems for Startups in France: Choosing Between IR and IS

Mathieu Fiscalis

Corporate taxation is an important factor to consider when choosing the form of your business and management strategy. In France, …

Financial Comparison of SARL and SAS: Which is Better for a Startup?

Alex Finley

In this article, we have explored how to choose the appropriate legal structure when starting a business. Now, let’s calculate …

Startup in France: How to Choose the Perfect Business Structure

Julien Legaro

How to Start a Startup in France? If you are aiming for financial freedom, you have likely had brilliant ideas …